There was a time when labor was more manual and it worked for most people in most industries. Back then you would not be seeing any of the skyscrapers filling up the space of massive lands in big cities. Now people live and work in the comfort of modern day machinery, especially in the workforce. Thanks to the rise of new technologies, things became easier to handle and quicker to finish. You may also see simple loan agreement templates.

Buildings began to rise faster than the recent years have seen, and it only got better. But never more without the equipment sample that made such nearly impossible tasks possible to finish. For most businessmen, a company is something that they have dedicated long years of hard work for. They dedicated sweat, effort, maybe even a few tears here and there. You may also see agreement templates.

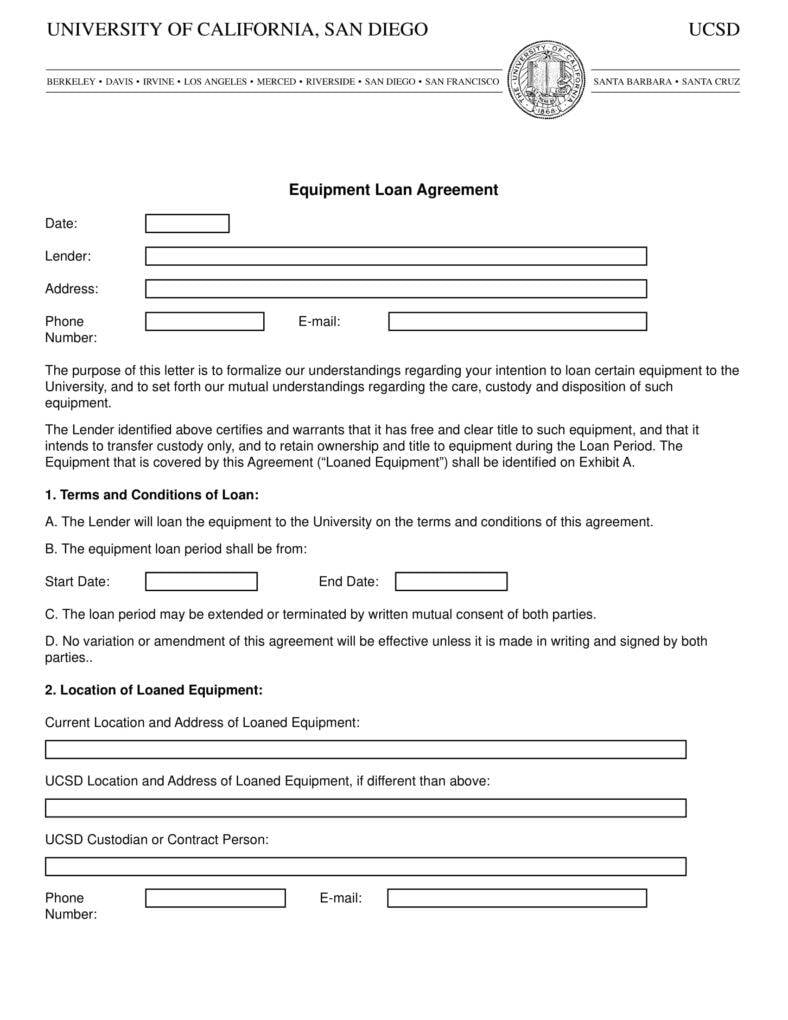

agreement 1 788x1020" width="530" height="500" />

agreement 1 788x1020" width="530" height="500" />

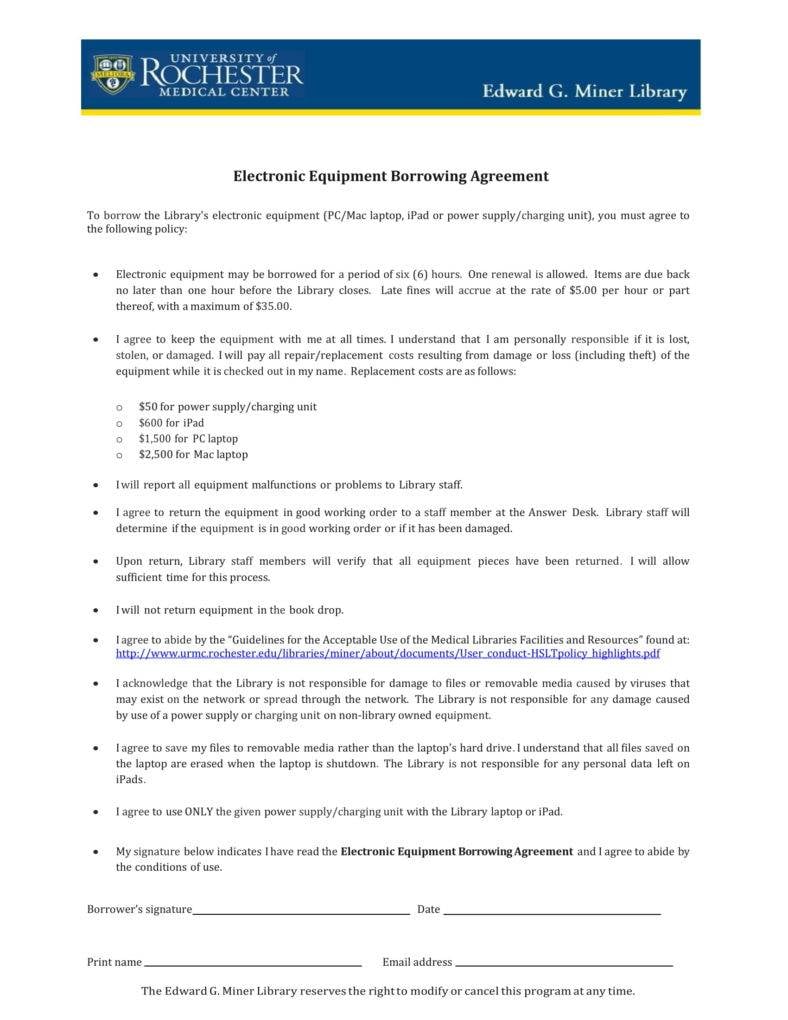

urmc.rochester.edu

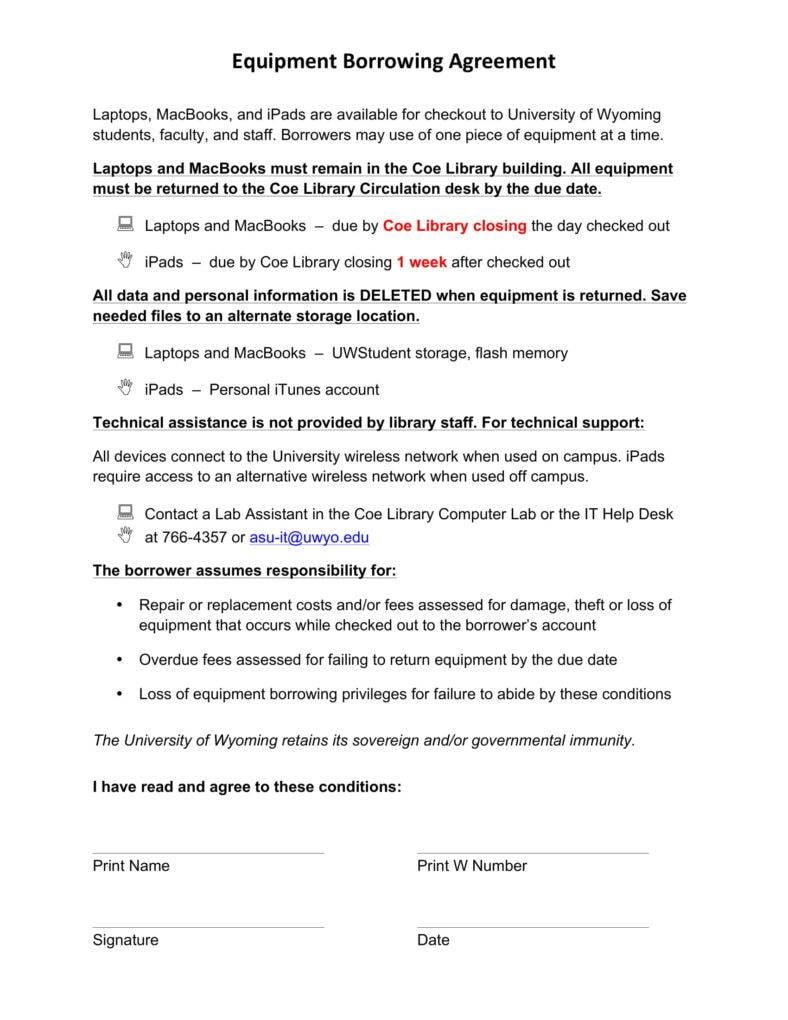

lib.uwyo.edu

agreement 1 788x1020" width="530" height="500" />

agreement 1 788x1020" width="530" height="500" />

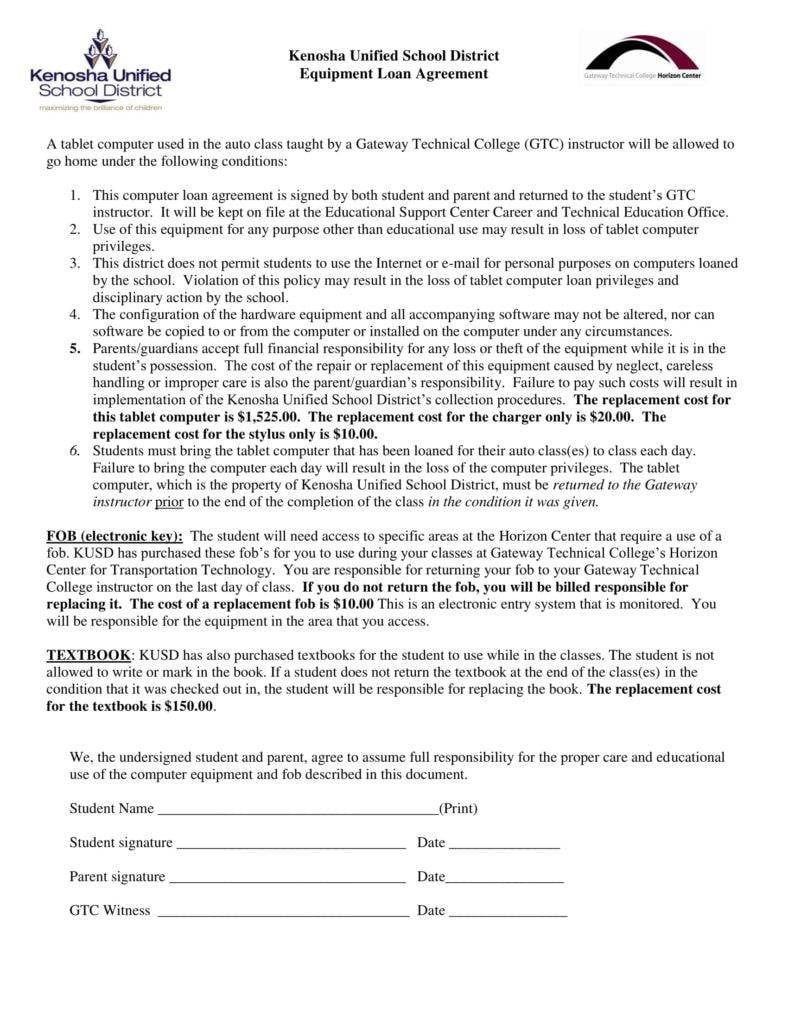

kusd.edu

It is understandable that they would want to do things right, including trying to cut some costs to be more economical in managing business operations. But, then there are also a lot of things that a businessman cannot do alone. Or he cannot do some tasks because he is short on machinery. And, because being able to do multiple tasks can’t be done by simple manpower alone, you face the dilemma of having to purchase equipment that could help make some heavy workload easier to handle. You may also like sample loan agreement.

agreement 1 788x1020" width="530" height="500" />

agreement 1 788x1020" width="530" height="500" />

bfs.ucsd.edu

However, purchasing tools or equipment to get a lot of tasks done can also prove to be a bad decision. These days, fledgling enterprises have found a better option in reaping benefits from renting equipment instead of purchasing them, although any size of company can also take advantage of the positive returns that loaning equipment brings.

Getting machinery on a sample loan instead of actual purchase or lease is often a better decision, especially if your small business is undergoing budget cuts. In some cases, an equipment tends to last long and can still work even when no upgrade is done and rarely needs a replacement as well. Setting terms for loaning it will be your best chance for your company to utilize the equipment right as soon as you need to, all the while also spreading payments for the loan over its shelf life. In turn, you will be able to gain profit from loaning the equipment, and the chance to pay off the loaning contractor sooner than what was agreed.

The purchase of brand new machinery is very costly and can affect your company’s budget. This is especially hard for construction companies working to manage their budget and the availability of equipment on site. Buying equipment also means being committed to specific equipment features. Loan or renting, therefore, avoids the upfront payment connected with purchasing which empowers the better allocation of a business’ financial resources.

This is pretty obvious. When a big part of your operations and tasks is largely dependent on machinery, which is often the case, you also have to plan ahead for the inevitable maintenance and repair costs that come with it. While repair and maintenance will still be necessary even for loaned equipment, there would be a big difference in the amount of money spent compared to purchased equipment since the cost of the former will be significantly lower. Heavy equipment needs regular maintenance checks for them to function safely and at an optimal level. Regardless of being rented or purchased, maintenance and repair is always needed. With loaning and renting, labor costs and time consumed because of maintenance and repair jobs become lower since there are also times when an equipment loan is agreed to be only for a short-term period. Even in long-term term loans, you rarely have to worry about keeping a machine in its best condition for as long as it survives wear and tear, thereby decreasing extra stress from what could be a management’s already tough schedule. In signing a loan agreement, make sure to check how it can help you focus on other areas of your business rather than having to map out a long-term maintenance plan for the equipment in question.

We exist in a dynamic industry and there are a lot of things that can influence the market. The rise and fall of the costs of machinery or the availability of jobs are really beyond your control. Equipment loans have the power to shield your business from the pitfalls of market fluctuations and financial downturns that are more than likely to arise. By avoiding a long-term commitment on an equipment, preferring rentals, loaning and leasing gives you the option to handle and survive the market’s rise and fall. This leaves you better prepared for the worst. You may also see loan agreement sample templates.

Owning machinery incurs depreciation costs in large sums. Then there’s the possibility of having to upgrade it, when some of its features are no longer useful for the tasks needed. It also requires a sizable investment on top of the initial purchase. It is understandable for equipment value to depreciate over time but it also makes for a lesser resale value so that it becomes difficult to recover what you have paid upfront. On the other hand, renting one would make you avoid such troubles because you wouldn’t have to worry about the machine’s long-term utilization. You may also see loan agreement forms.

Many modern-day types of machinery can be complex and hard to operate for people who aren’t equipment-savvy. If you buy an equipment, you are left to run it on your own and figure out how you can utilize it properly. When it is an equipment loan, the contractor, or loaning party can show you how it works and how you can maximize its functions to serve your needs for the intended task. You may also see loan agreement form templates.

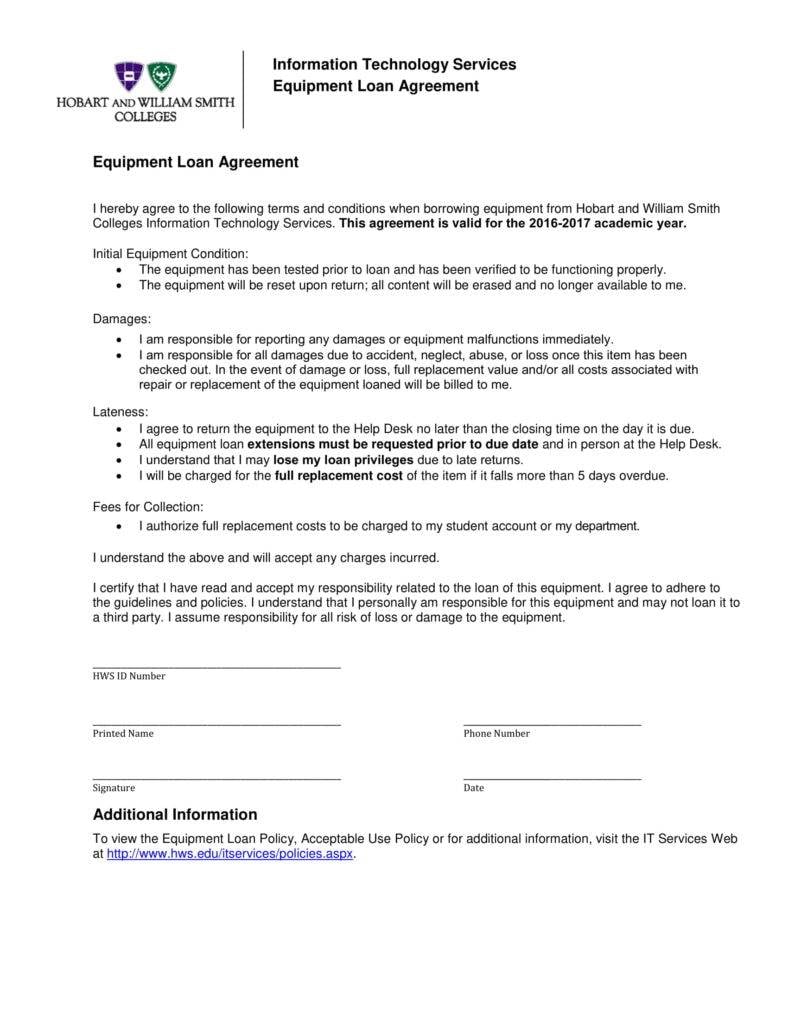

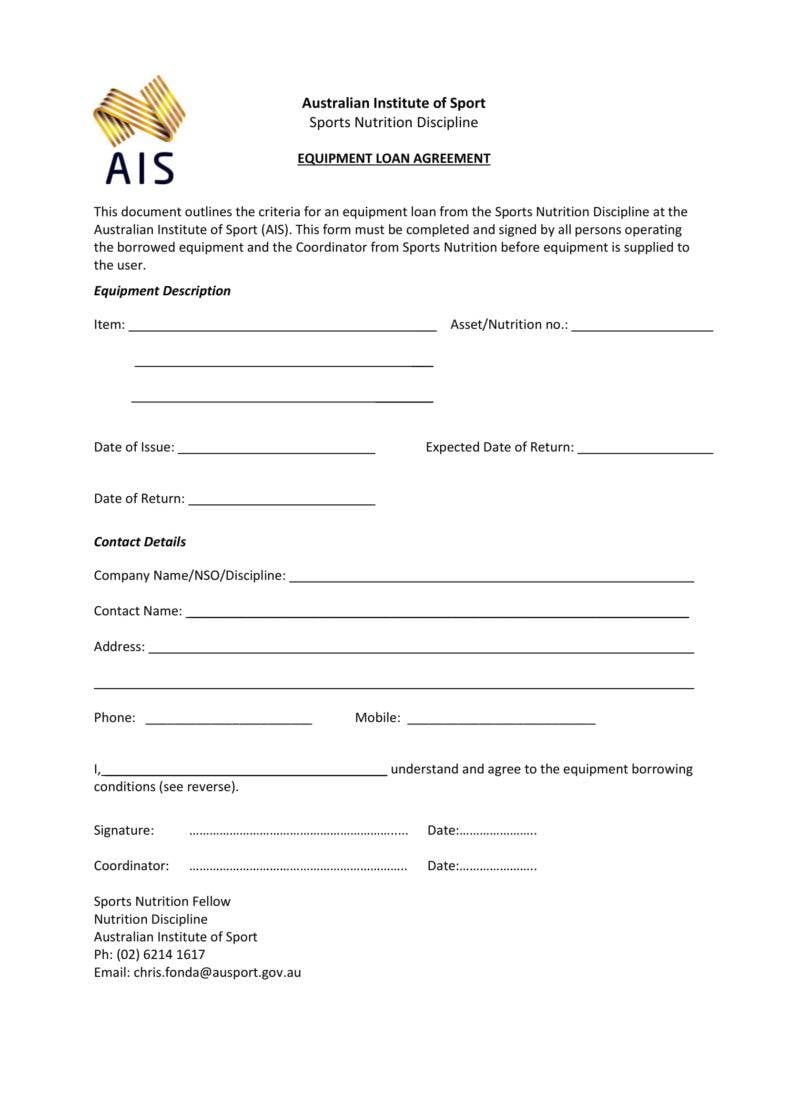

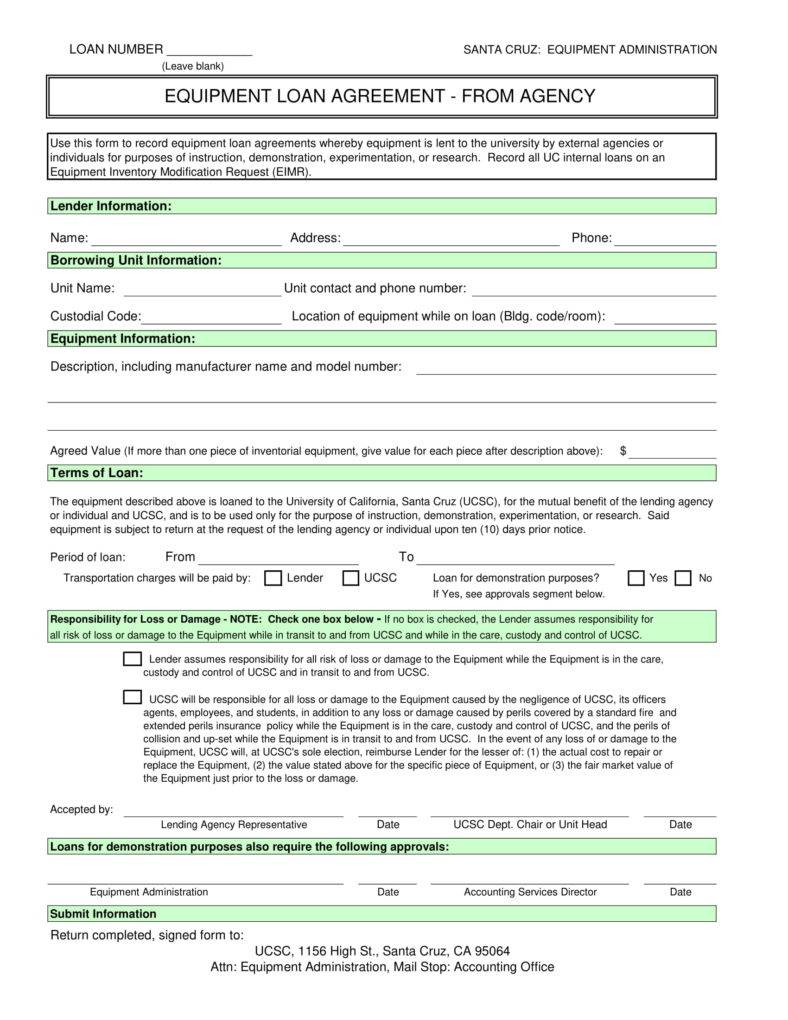

agreement 1 788x1020" width="530" height="500" />

agreement 1 788x1020" width="530" height="500" />

hws.edu

shop.ausport.gov.au

financial.ucsc.edu

The popularity of renting and loaning equipment have risen to new levels for different reasons. Most of these lean on the fact that the rising costs of equipment purchase coupled with an unpredictable market have encouraged companies to think of options in saving money as much as they can, whenever they have the opportunity. And in many cases, equipment loan has proven to be a viable solution for many businesses, allowing them to manage costs, maintaining a steady cash flow and proper simple budget allocation in the process.