Now you can generate instant limits with your existing shares available in your Demat A/C without selling them using Shares as Margin facility. These limits can be used to buy stocks in MTF or trade in FNO. It's simple hassle free process to generate limits.

Visit “Shares as Margin”

Click on "Pledge & Create" You will receive a link Get limits in your account| Plan | Delivery Brokerage(%) | MTF Interest rates (p.a) |

|---|---|---|

| ₹ 9,999 | 0.07 | 9.69% |

| ₹ 4,999 | 0.1 | 9.69% |

| ₹ 2,999 | 0.15 | 16.49% |

| ₹ 1,999 | 0.18 | 16.49% |

| ₹ 999 | 0.22 | 20.49% |

| ₹ 299 | 0.25 | 20.49% |

| Plan | Delivery Brokerage(%) | MTF Interest rates (p.a) |

|---|---|---|

| ₹ 1,00,000 | 0.07 | 9.69% |

| ₹ 50,000 | 0.12 | 16.49% |

| ₹ 25,000 | 0.15 | 16.49% |

| ₹ 12,500 | 0.18 | 20.49% |

| ₹ 5,000 | 0.22 | 20.49% |

| ₹ 2,500 | 0.25 | 20.49% |

Interest will be calculated on the funded amount for the number of days you hold position in MTF. The number of days would start from the exchange pay-in date for the settlement of the respective transaction and charged till the date the funds are actually received. The interest shall be charged per day basis including non-working days.

Interest will be charged for funded amount or Shares as Margin amount blocked against your MTF positions for the number of days you hold.

No, ICICIdirect don’t charge any minimum interest amount.

Default interest rate for your position is charged at 0.06% per day.

You can choose from the available prime plans to reduce interest rate as applicable for your respective plan.

With the introduction of Pledge Model in September 2020, it is now mandatory for customers to pledge their shares purchased under Margin Trading. Pledging is mandatory for creating limits against demat shares as well

You can check the status of your pledge request on the Open Positions page. Pledge will be created onT+1 day for stocks bought in Margin Funding(MTF).

Yes. You will need to Pledge your shares to hold positions in Margin Trading beyond T day.

In case you do not confirm the Pledge for the shares bought under Margin Funding (MTF) then your positions will be squared off on T+1 day.

If you have taken a fresh position in Margin Trading, you will receive a link on your registered Mobile number and E-mail id after 6PM. On opening this link and entering your PAN number the page will display a list of all those stocks you bought on that day under which you have taken position under Margin Trading product. You will need to follow below 2 steps:

Step 1: Open the link received from the Depositories, enter PAN and select stocks that you want to proceed with Pledging

Step 2: Click on 'Generate OTP' and authenticate your Pledge by entering the OTP received on your Mobile number and you are done.

You will need to Pledge your shares Within 9:30 PM on T day (same day). The stocks will be pledged on T+1 day

Yes, there will be a charge of Rs. 20 + GST for Pledging / Unpledging of MTF Shares in accordance with depositories NSDL and CDSL. These charges are applicable on a per-ISIN basis in each instruction.

You will be able to square off your Margin Trading positions after doing EDIS mandate. In this process, you will be required to authenticate the transaction by confirming the MPIN & OTP received from your depository. This mandate will be valid for that day.

e-DIS mandate can be given as follows:

On the Order Verification page, you will be redirected to your depository e-DIS mandate page to complete two-factor authentication by entering MPIN and OTP

In case of CTD option, you will be able to do Convert to Delivery (CTD) for your Margin Trading position from Open Positions page by using convert to delivery option.

If you have taken a fresh position in Margin Trading, you will receive a link from the Depositories at the end of day. If you do not receive any link, then-

Click here for the link if you have an NSDL account

Click here for the link if you have a CDSL account

IF you do not pledge the shares with in the given time, your position will be auto squared off on T+1 day. Once your position is auto squared off, you will not be able to buy that stock in MTF on same day. You can buy it again on next day.

Once you buy a stock in MTF, Pledge link is triggered in the evening. Once the pledge is triggered, you won’t be able to place overnight MTF /Cash order in that particular stock until it is pledged.

If you pledge within the given time i.e 10PM of T day, your pledge will be created on T+1 day & you will be able to take fresh position in that stock.

If you buy any stock in Margin Funding(MTF), then you won’t be able to place the following orders in that particular stock for the day.

eATM sell order

Cash Buy today sell tomorrow (BTST) order

Spot sell order

If you place the following orders in any stock, you won’t be able to buy that stock in MTF on that day.

Cash sell order

eATM sell order

Cash Buy today sell tomorrow (BTST) order

Spot sell order

If you buy any stock in delivery or convert any stock to delivery from margin mode (intraday), then you won’t be able to place MTF sell order in that stock for the day.

If you place MTF sell order in any stock, then you won’t be able to place the following orders in that stock for the day

Cash buy order

Convert to delivery(CTD) from margin mode (intraday)

1. If QTY bought = QTY sold then no pledging will be required, as the bought quantity will be auto adjusted against sold quantity.

For ex: you sell 50 quantities of stock X from your MTF open position page and then again buy 50 quantities of stock X in MTF on same day, then pledging won’t be required as the bought quantity will be adjusted against sold quantity as the quantity is same for both

2. If QTY bought QTY sold, then you will be required to pledge only the difference QTY

For ex: you sell 50 quantities of stock Z from your MTF open position page and then again buy 60 quantities of stock Z in MTF on same day, then you will be required to pledge only 10 shares (QTY bought – QTY sold) as the balance quantity will be adjusted against sold quantity

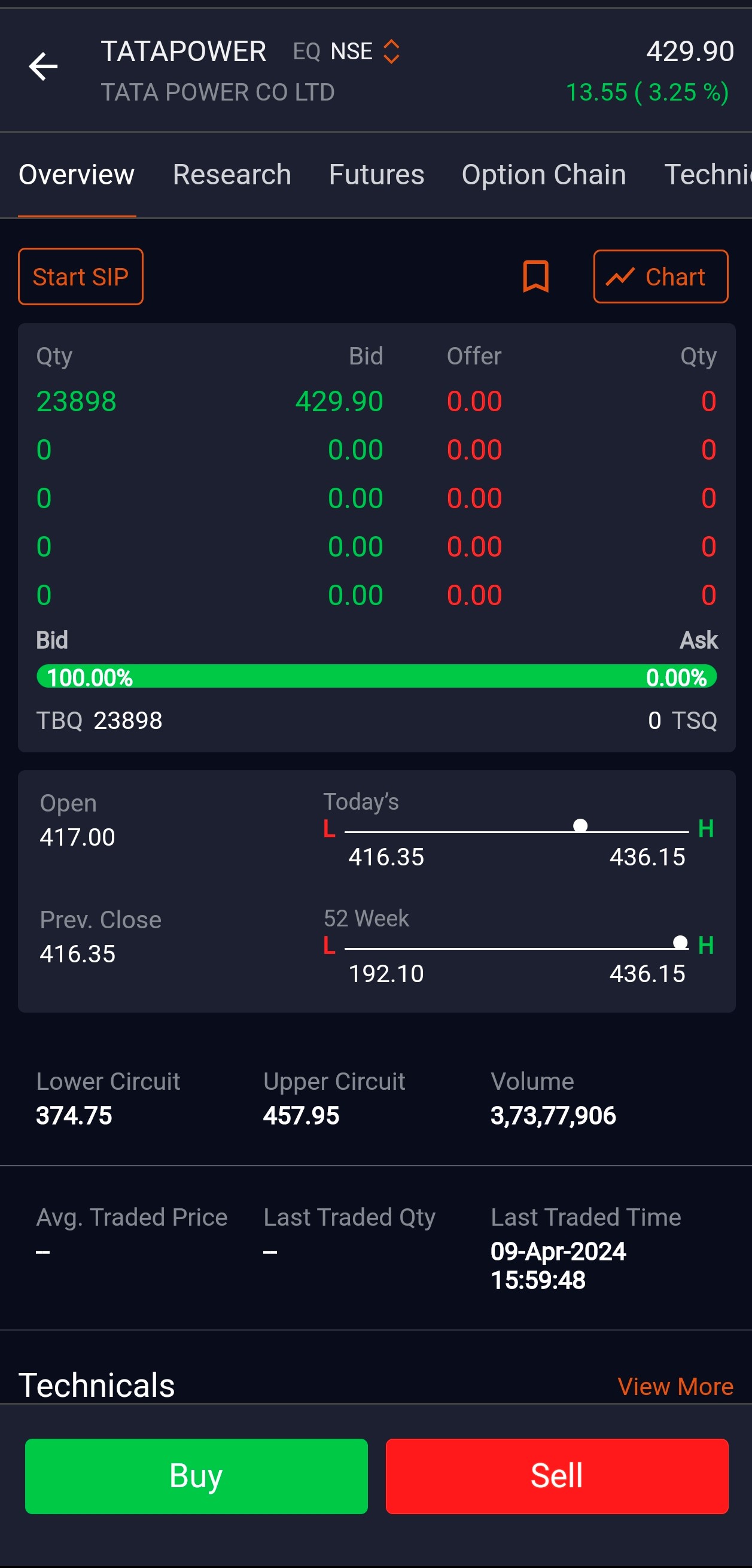

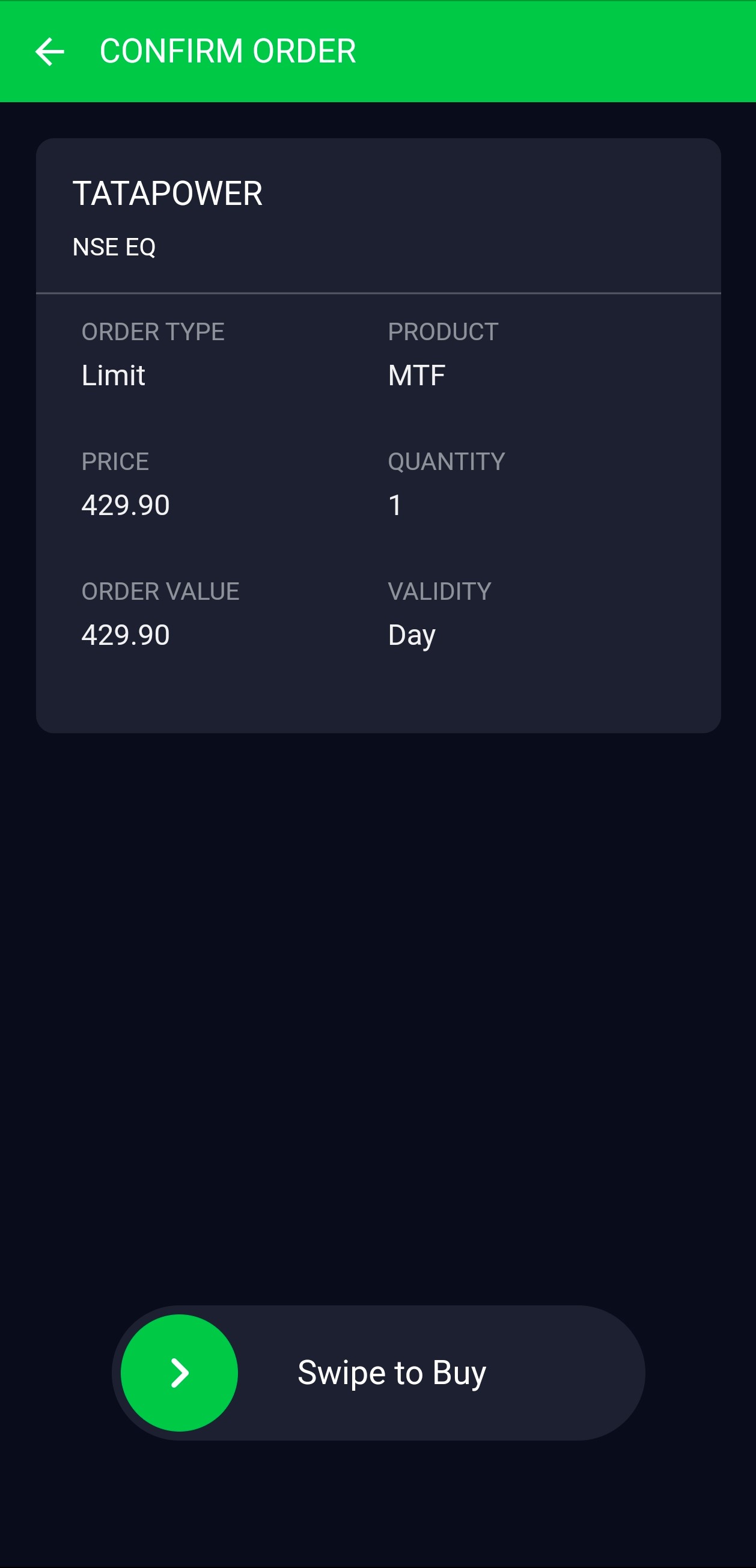

You can buy stocks by paying an initial small amount called margin amount and rest of the outstanding amount will be funded by ICICI Securities. You can sell/square off the stocks anytime or convert the stocks to delivery (CTD) within the expiry date. Interest will be charged for the funded value.

In other words, MTF is leveraged investment product which allows you to buy shares with cash or collateral/pledged shares(SAM).

Unlike for a 'Cash buy' order, you do not have to pay the full order value for MTF order.

MTF positions will have a default validity period of 30 days and the same will be auto renewed with 30-day intervals subject to a maximum validity (Expiry) of 360 days from the date of purchase.

MTF positions will have a default validity period of 30 days and the same will be auto renewed with 30-day intervals subject to a maximum validity(Expiry) of 360 days from the date of purchase.

You can use your existing shares to create limits which can be used to buy shares in MTF product.

When a stock is bought in MTF, you can either hold it or pay the full amount and take delivery of the stock in your demat account. CTD option is available in Stocks tab –> Open Positions –> MTF (Pay Later)/Intraday.

Under Open Position-Intraday/MTF, you can find the 'Convert To Delivery' (CTD) option under Actions column wherein, by paying the remaining outstanding amount, you can take delivery of the stocks.

CTD can be done on the same day or after the pledge confirmation(As per new sebi guideline w.e.f Sep 2020) for MTF position.

No extra charges will be levied for CTD except if CTD is done on same day where delivery brokerage will be applicable for the trade.

Yes, you can sell 100% of the shares bought on previous day in MTF under open positon - MTF.

Once you have an open position in MTF, it is visible under the Intraday tab under Open Positions on the same day and under MTF page from next day onwards. Under actions, you will find an option to square off the position.

You will continue holding the shares till expiry date or take delivery of shares within the specified time.

ICICI securities will square off the trade on expiry date. This is subjected to change / review by ICICI securities Ltd from time to time.

Yes. Your dividend will be credited to your linked bank account.

In order to buy stocks under margin products, a part of the total amount needs to be paid initially. This amount is termed as Initial Margin. Margin differs across stocks and is different for different products. To view Initial and Minimum margin for any stock, visit Stock List page on www.icicidirect.com. You can estimate the margin amount by calculating it as a percentage of total position value.

For example, if Mr. X buys 100 shares of ABC Ltd in Margin Trading at Rs.100 per share, the total value of his purchase becomes Rs. 10,000. If initial margin applicable on ABC Ltd is 30%, it means Mr.X will only have to pay Rs. 3000 to take position in this stock and he can payback the remaining Rs. 7000 before the expiry date.

You can use cash or pledge shares/shares as margin(SAM) for buying stocks in MTF.

Your position under Margin Trading follows Minimum Margin requirement. Minimum margin is that price beyond which if the current market price falls, the position gets squared off. A way to track your position's performance is by keeping a check on Trigger Price under open position – MTF/Margin. If your stock price is reaching closer to the Trigger Price, it means that your position is incurring a loss and will get squared off on hitting the trigger price. To avoid squaring off of your positions, you can always Add Margin for Margin Trading positions from the Open Positions page.

If the position is squared off on the same day, the brokerage gets charged as per the rate under Margin segment of your selected brokerage plan whereas if the position is carried forward, cash brokerage is charged.

Interest is calculated on the outstanding amount of your open position, i.e., (Total Position Value - Initial Margin paid). In case, where the position is taken using shares as margin/pledge shares (SAM), the interest is chargeable on the entire position value.

Interest is charged from T+1 day till the end of selling settlement cycle. For ex: If you have taken a position on Monday, June 22, 2020 and carried it forward, interest will be charged from Tuesday, June 23, 2020. Now, if you square off your position on Monday, June 29, 2020, you will be charged interest till Tuesday, June 30, 2020.

Interest is charged at 0.056% per day or 20.49% per annum. However, the same can be reduced to as low as 0.027% per day or 9.69% per annum with Select Prime and Prepaid plans.

As per SEBI's new guidelines, for the purpose of providing securities as margin, the existing Shares as Margin process is getting replaced by the mandatory Margin Pledge process (via OTP authentication) in Depository system, i.e., you will have to pledge shares in favour of ICICIdirect to avail securities limit.

Similarly, in case of buying shares under Margin Trading facility, you will have to pledge those shares in favour of ICICIdirect to continue holding the positions under Margin Trading.

This new process has been implemented to ensure the safety and security of your shares.

You can create a fresh pledge request by following the below steps

you do not select all stocks while providing pledge confirmation, your unselected stocks will not get pledged and therefore, the limits generated against those stocks will become zero.

If you have neither received any link on your mobile number nor on email id from CDSL/NSDL, please check whether your correct Mobile number and E-mail id is registered with the Depositories. If your contact details are correct and you still haven't received the link-

Click here for the link if you have an NSDL account

Click here for the link if you have a CDSL account

You can track your pledge request from the Request Book under Shares as Margin Section. Once your pledge request is successfully confirmed through OTP authentication the status in the Pledge Book will reflect as "Confirmed".

Yes, there will be a charge of Rs.20 + GST for pledging/unpledging and invoking the Pledge.

A. Please follow below process to check your existing mobile number and email id details: Login to Linked ICICI Bank Internet Banking > Investments and insurance > Demat > View Personal Details

B. To change your mobile number and email with the depository, follow below process: Login to Linked ICICI Bank Internet Banking > Investments and insurance > Demat > Service requests > Registration for Mobile Alerts facility

| Type of Instruction (Per ISIN in an instruction) | Pledging Charges in Rs. |

|---|---|

| Margin Trading Pledge : MTF Pledge Creation/Closure/Invocation | 20 |

| Shares as Margin Pledge Creation/Closure/Invocation | 20 |

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. ( Member Code : 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund, Corporate Fixed Deposits, Bonds, IPO, NPS, Wealth Management, Corporate Services, Portfolio Management Services, Alternate investment funds, Tax planning, Succession planning and Loans related services are not Exchange traded products and I-Sec is acting as a distributor to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. Please note, Insurance related services are not Exchange traded products and I-Sec is acting as a corporate agent to solicit these products. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Please note Brokerage would not exceed the SEBI prescribed limit.

Global Investment Platform is offered by ICICI Securities in collaboration with interactive brokers. Any complaint / dispute pertaining to the same would not be entertained by Stock Exchanges. Involvement of ICICI Securities Ltd. is restricted to Referral Only. ICICI Securities Ltd. does not offer this product directly to customers. Client’s details will be shared with third party stock broker (Interactive Brokers Group, Inc.) with expressed consent from clients. All dealings including KYC will be executed by third party stock broker (Interactive Brokers Group, Inc.) directly with client and ICICI Securities Ltd. will not incur any personal financial liability.

One Click Portfolio and Premium Portfolio related services are offered under Research Analyst license of I-Sec. Any complaint / dispute pertaining to the same would not be entertained by Stock Exchanges.

Margin Trading is offered as subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017 and the terms and conditions mentioned in rights and obligations statement issued by I-Sec.

Cloud Order feature is offered by ICICI Securities. Any complaint / dispute pertaining to the same would not be entertained by Stock Exchanges.

ICICI Securities Ltd. acts as a referral agent to ICICI Bank Ltd. for loan against securities related services & the loan facility is subjective to fulfilment of eligibility criteria, terms and conditions etc.

* Please note Brokerage would not exceed the SEBI prescribed limit.

Customer Care Number

Calculators Account Opening Demat Account Trading Account ICICI Bank Group websites Disclaimer : +The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning, ESOP funding etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. Pay minimum 20% upfront margin of the transaction value to trade in cash market segment. Investors may please refer to the Exchange's Frequently Asked Questions (FAQs) issued vide NSE circular reference NSE/INSP/45191 dated July 31, 2020; BSE Notice no. 20200731-7 dated July 31, 2020 and NSE Circular Reference No. NSE/INSP/45534 dated August 31, 2020; BSE Notice No. 20200831-45 dated August 31, 2020 and other guidelines issued from time to time in this regard. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month.

Disclaimer : ICICI Securities attempts to ensure the highest level of integrity, correctness and authenticity of the content and data updated on the site. However, we may have not reviewed all of the contents and data present on the site and are not responsible or we take no guarantees whatsoever as to its completeness, correctness or accuracy since these details are acquired from third party. In the event that any inaccuracy arises, we will not be liable for any loss or damage that arises from the usage of the content.

Features such as Advanced Charts, Watchlists, F&O Insights @ Fingertips, Payoff Analyzer, Basket Order, Cloud Order, Option Express, e-ATM, Systematic Equity Plan (SEP), i-Track, i-Lens, Price Improvement Order, Flash Trade, Strategy Builder etc., are offered by ICICI Securities. The securities quoted are exemplary and are not recommendatory. Such representations are not indicative of future results. ICICI Securities is not making the offer, holds no warranty & is not representative of the delivery service, suitability, merchantability, availability or quality of the offer and/or products/services under the offer. Any disputes regarding delivery, services, suitability, merchantability, availability or quality of the offer and / or products / services under the offer must be addressed in writing, by the customer directly to respective merchants and ICICI Securities will not entertain any communications in this regard. The information mentioned herein above is only for consumption by the client and such material should not be redistributed.

Name of Investment Adviser as registered with SEBI : ICICI Securities Limited

Type of Registration : Non Individual

Registration number : INA000000094

BASL Membership Certificate no- BASL1136

Validity of registration : Valid till suspended or cancelled by SEBI

Registered office Address : ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400025

Telephone numbers : 022 - 6807 7100

Email id : mfadvisory@icicisecurities.com

Name of Principal Officer : Mr. Anupam Guha

Contact no : 022 - 6807 7100

Email id : mfadvisory@icicisecurities.com

Name of the Compliance officer: Mr. Nirav Shah

Contact number: 022 - 4084 0336

Email id : mfadvisory@icicisecurities.com

Name of grievance redressal Officer:- Mr. Sachin Ubhayakar

Telephone no. of grievance redressal Officer:- 022 - 6807 7400

Email id : mfadvisory@icicisecurities.com

Corresponding SEBI regional / local office address : Securities & Exchange Board of India, Plot No.C4-A, 'G' Block Bandra-Kurla Complex, Bandra (East), Mumbai - 400051, Maharashtra

SEBI Research Analyst Registration Number - INH000000990 Name of the Compliance officer (Research Analyst): Mr. Atul Agrawal Contact number: 022 - 40701000

None of the research recommendations promise or guarantee any assured, minimum or risk free return to the investors.

Disclaimer : Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Attention Investors : Prevent unauthorized transactions in your account. Update your mobile numbers/email IDs with your stock brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Issued in the interest of Investors (Ref NSE : Circular No.: NSE/INSP/27346, BSE : Notice 20140822-30.) It has been observed that certain fraudsters have been collecting data from various sources of investors who are trading in Exchanges and sending them bulk messages on the pretext of providing investment tips and luring the investors to invest in bogus entities by promising huge profits. You are advised not to trade on the basis of SMS tips and to take an informed investment decision based on authentic sources. issued in the interest of investor of investor (RefNSE : circular No.: NSE/COMP/42549, BSE:Notice 20191018-7)

ICICI Securities Limited:

Registered Office:

ICICI Venture House,

Appasaheb Marathe Marg,

Prabhadevi, Mumbai - 400 025, India

Tel No: 022 - 6807 7100

Fax: 022 - 6807 7803

For any customer service related queries, assistance or grievances kindly Call us at 1860 123 1122 or Email id: headservicequality@icicidirect.com to Mr. Bhavesh Soni

ICICIdirect.com is a part of ICICI Securities and offers retail trading and investment services.

Member of National Stock Exchange of India Limited (Member code: 07730), BSE Limited (Member code: 103) & Metropolitan Stock Exchange (Member code: 17680),Multi Commodity Exchange of India Limited (Member code: 56250) SEBI Registration number INZ000183631

Name of Compliance Officer (Broking) : Ms. Mamta Shetty E-mail Address : complianceofficer@icicisecurities.com / Tel No: 022-4070 1000

Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Please note Brokerage would not exceed the SEBI prescribed limit.

Margin Trading is offered as subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017 and the terms and conditions mentioned in rights and obligations statement issued by I-Sec.

Account would be open after all procedure relating to IPV and client due diligence is completed.

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Mumbai - 400025, India, Tel No: 022 - 6807 7100, Fax: 022 - 6807 7803. Composite Corporate Agent License No.CA0113. Insurance is the subject matter of solicitation. ICICI Securities Ltd. does not underwrite the risk or act as an insurer. The advertisement contains only an indication of the cover offered. For more details on risk factors, terms, conditions and exclusions, please read the sales brochure carefully before concluding a sale.

Responsible Disclosure: In case you discover any security bug or vulnerability on our platform or cyber-attacks on our trading platform, please report it to ciso@icicisecurities.com or contact us on 022-40701841 to help us strengthen our cyber security.